457 b calculator

This relationship also allows both teams to fully collaborate for the. How much do I need to make for a 900000 house.

This Calculator Is Nerdy And Aesthetic Yanko Design Calculator Medical School Motivation Graphing Calculators

If you have a combination of two plansa 457b and a 403b or a 457b and a 401kyou can contribute the maximum amount to both plans.

. For 2022 the 457b contribution limit is 20500 for those under 50 with an optional catch-up contribution limit of 6500 for those 50 or older. The limit for all savings to 457b plans is the lesser of 100 of the workers includable pay or the elective deferral limit. Teachers for example might be offered both 403b and 457b plan options.

And 2 Ensure plans are structured and operate according to IRS requirements. A 457b plan is similar to a 401k but its available only for employees of state and local. Journal of Financial Economics 145 nos.

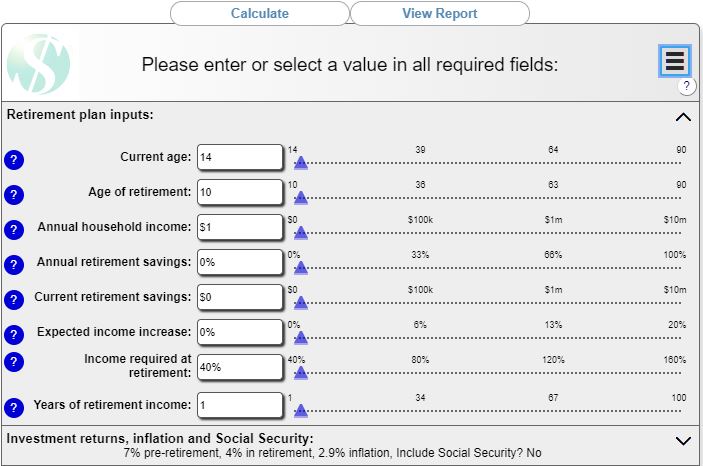

457 Savings Calculator Overview. What may my 457b be worth. How Much House Can I Afford.

Rent vs Buy. 457 Savings Calculator A 457 can be one of your best tools for creating a secure retirement. Internally Savings Plus often refers to the 401k and 457b Plans as main plan accounts to distinguish them from the Part-Time Seasonal and Temporary PST Employees Retirement Program mandatory account.

OMNI clients have come to rely upon. Number of other dependents. Specifically we study the.

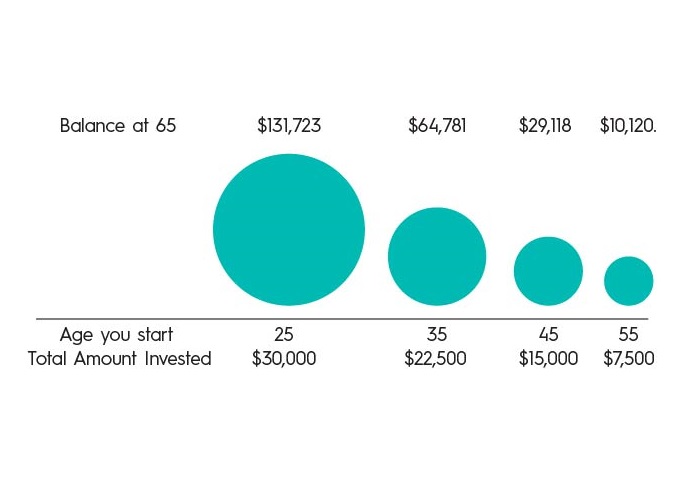

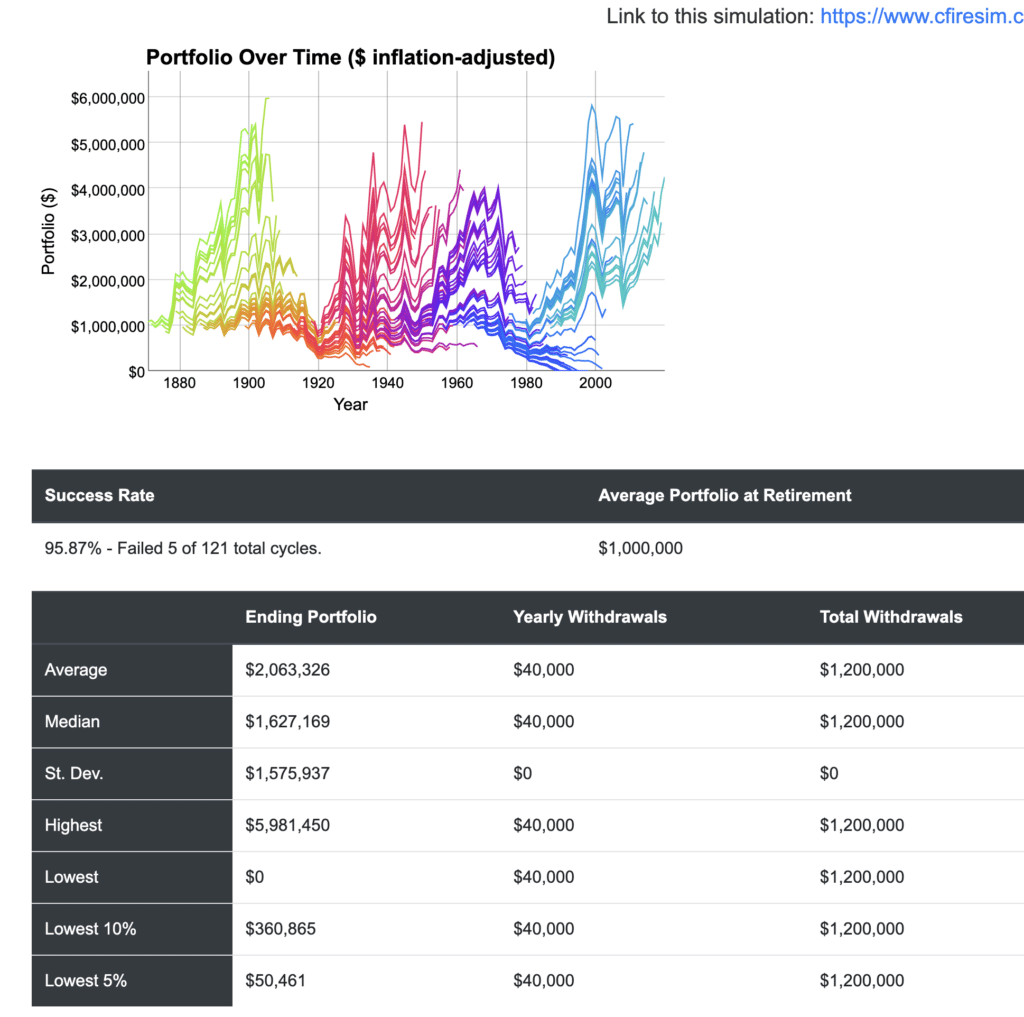

But predicting how much of a nest egg youll eventually be able to end up with is challenging. What may my 403b Plan be worth. The number of years you plan to make contributions to the 529 plan.

This 403b calculator can help you determine how much you can save for retirement. A 457b is similar to a 401k in how it allows workers to put away money into a special retirement account that provides tax advantages letting you grow your savings tax-deferred over time. Contribution Limits for a 457b Account.

A 457b is a type of tax-advantaged retirement plan for state and local government employees as well as employees of certain non-profit organizations. Before-tax return on savings The return you anticipate to receive. A 457 savings plan is a great way to save for retirement if youre fortunate enough to qualify for one.

What is the impact of increasing my 457b contribution. When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour options might include a 401k plan or a 457b plan. In its crystalline form it is a brittle dark lustrous metalloid.

Initial balance or deposit Annual savings amount. Original loan balance Annual. This 457 Savings Calculator is designed to help you make that prediction as accurately as possible.

Financial Wellness Center MAC Calculator Contribution Guidelines. Thereby realize tremendous savings in interest payments. Federal Income Tax Calculator 2022 federal income tax calculator.

Number of children under age 17. The 401k and the 457b Plans are named for the sections of the Internal Revenue Code IRC that regulate them. This calculator is intended for use by US.

B457b compliance and administration services TSACG and US. The elective deferral limit for 457b plans is also 20500 for 2022 and 19500 for 2021. Use this calculator to help determine if you are eligible for the 457b 3-year Special Catch-Up election and if so how much you can contribute to your employers 457b retirement plan in the current year.

The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change since 1987. The calculator will also help identify how much you may contribute under the Age 50 Catch-Up. Click here for a 2022 Federal Tax Refund Estimator.

ASCII characters only characters found on a standard US keyboard. 2 Part B August 2022 When the Local Newspaper Leaves Town. SmartAssets award-winning calculator can help you determine exactly how much you need to save to retire.

A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. It provides you with two important advantages. 1 Work collaboratively with our clients to implement and maintain programs that enhance the perception of the 403b andor 457b benefit to increase participation.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Your job income salary year. In its amorphous form it is a brown powder.

You can adjust those using the. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. First all contributions and earnings to your 457 are tax-deferred.

The calculator will then reply with an income value with which you compare your current income. While there are similarities between a 457b and a 401k there are also key differences to keep in mind. Add the type of retirement accounts available to you and the current balances.

Number of years contributions are made. What may my 403b Plan be worth. 401k 403b or 457b Account.

Determine if you are eligible for the 457b 3-year Special Catch-Up election. What is the impact of increasing my 457b contribution. Jonas Heese Gerardo Pérez Cavazos and Caspar David Peter.

The calculator will take all this into account and will calculate your bi-weekly payment amount your total interest savings and how much faster you will pay off your auto loan. Our consulting services are designed to meet two primary goals. As the lightest element of the boron group it has three valence electrons for forming covalent bonds resulting in many compounds such as boric acid the mineral sodium borate and the ultra-hard crystals of.

We examine whether the local press is an effective monitor of corporate misconduct. Another benefit to 457b plans is that they work well with other plans. While the 457b shares a few features with.

Start building on your retirement. 6 to 30 characters long. The annual savings amount you plan to set aside in the 529 plan.

Both plans allow you to contribute money towards retirement on a tax-deferred basis. Additionally employees who are within three years of retirement age as specified in the plan can make special 457b catch-up contributions. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt.

Initial investment amount The existing fund balance or initial contribution if any into your 529 plan. Individual Its easy to enroll in your employers plan. Boron is a chemical element with the symbol B and atomic number 5.

If you wish to see what effect changing any of the basic values would have varying the loan amount interest rate length etc. Second many employers provide matching contributions to. Must contain at least 4 different symbols.

Use this calculator to determine the potential future value of your savings. Or 457b account details. What may my 457b be worth.

You only pay taxes on contributions and earnings when the money is withdrawn. The Effects of Local Newspaper Closures on Corporate Misconduct.

403 B Vs 457 B Differences And How To Spend Efficiently 2022

Bmi Calculator By Life

Are You Saving With A 403 B Or 457 B Plan Yet Montgomery County Public Schools

457b Plans Non Qualified Deferred Compensation Plans Apa

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Retirement Calculator Sams Investment Strategies

Test Your Math Strength Against Former Pro Football Player John Urschel

457 Deferred Compensation Plan

A Guide To 457 B Retirement Plans Smartasset

916 457 Images Stock Photos Vectors Shutterstock

457 Vs Roth Ira What You Should Know 2022

What Is A 457 B Plan Forbes Advisor

5 Best Retirement Planners And Apps 1 Is Free Robberger Com

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Best Free Online 401k Calculator Websites List Of Freeware

Future Value Calculator

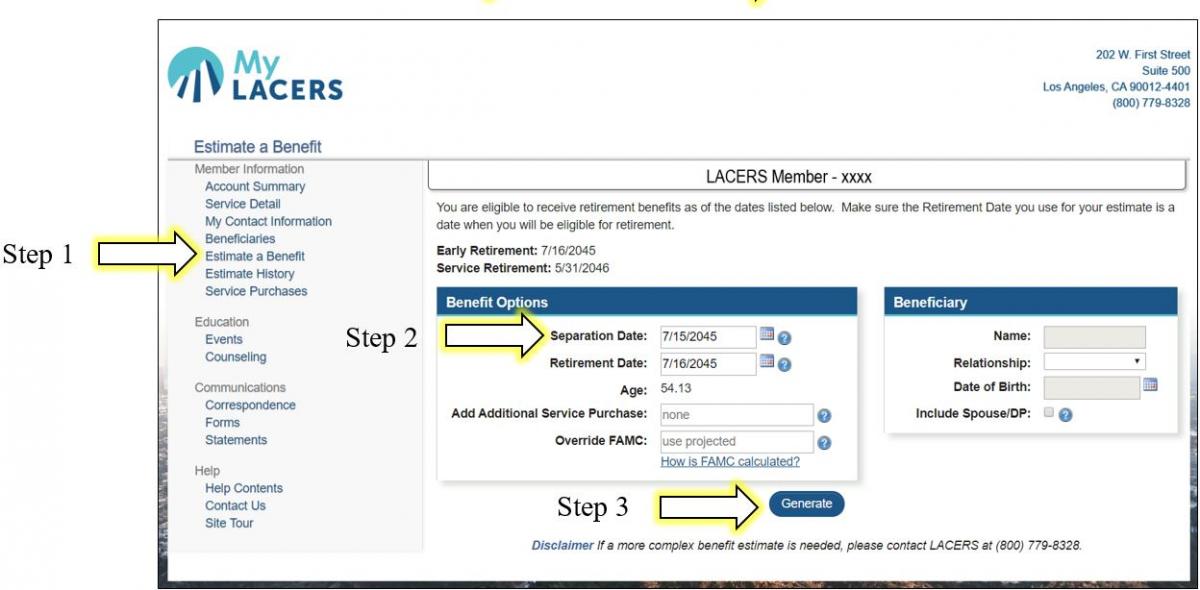

Explore Benefit Calculators Los Angeles City Employees Retirement System